Andaman Aceh Holds Significant Gas Reserves; Indonesia Aims to Construct a Refinery

KONTAN.CO.ID - JAKARTA. The Ministry of Energy and Mineral Resources (ESDM) is considering the construction of a new refinery in Aceh to accommodate the abundant gas potential from the Andaman Work Area (WK).

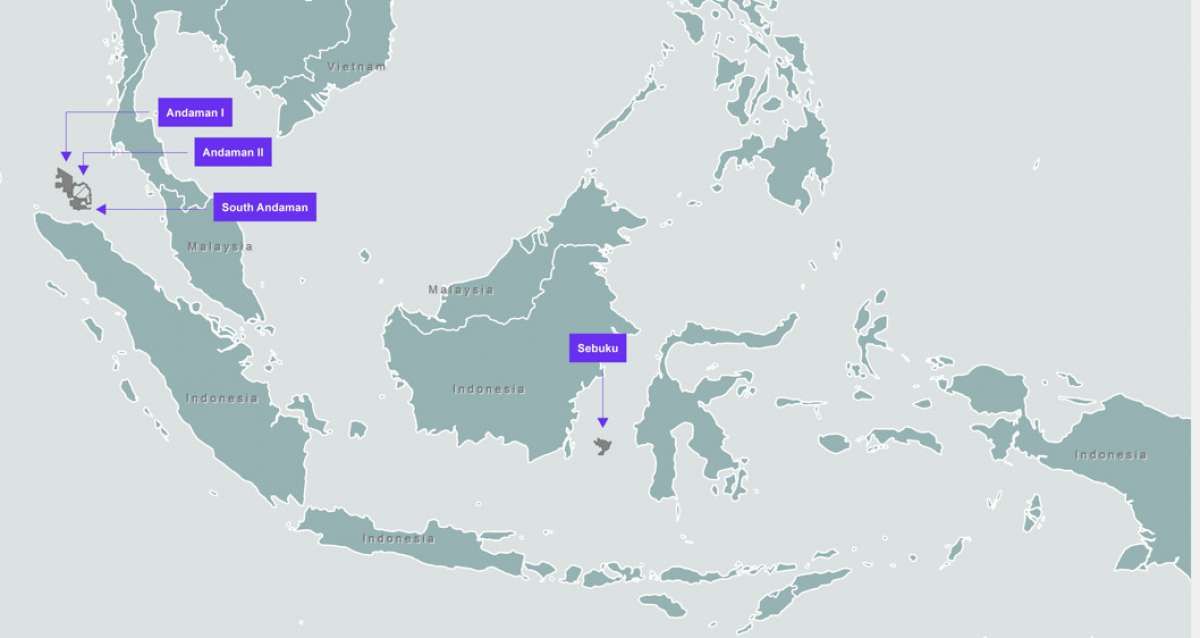

According to data from the Ministry of ESDM, the total resources in the Andaman area are estimated at 4.965 million barrels of oil equivalent (MMBOE). Currently, there are two major consortiums of KKKS there, namely Harbour Energy and Mubadala Energy.

Recently, Mubadala Energy announced the discovery of gas potential in South Andaman, with the Layaran-1 well reaching 6 trillion cubic feet (TCF) of gas-in-place.

The Director General of Oil and Gas at the Ministry of ESDM, Tutuka Ariadji, explained that the construction of a new refinery in Aceh is one option that the government has considered to accommodate the gas output from the Andaman Block.

“Because not all the equipment at the Arun refinery can be used. The revitalization of the Arun Refinery is being carried out. However, not all the equipment there can be used immediately, it can't be fixed immediately. If it's old, it needs to be replaced,” he said when met at the Ministry of ESDM Building, on Thursday (11/1).

He said, if this plan is implemented, anyone can build a new refinery in Aceh. For example, Mubadala Energy is the operator in South Andaman or other parties.

Although this option has been considered, so far the plan to build a refinery is not yet concrete because it requires proof of gas reserves first.

Previously, the Special Task Force for Upstream Oil and Gas Business Activities (SKK Migas) stated that they would focus on validating the large gas potential in the Andaman Block.

The Head of the Program and Communication Division of SKK Migas, Hudi D. Suryodipuro explained, that information about this giant discovery has been a breath of fresh air for the upstream oil and gas industry in Indonesia. Therefore, acceleration of the exploration and production process is highly anticipated considering gas will be Indonesia's main energy source.

“The process of proving and validating the size of gas and condensate reserves is very much needed as a basis for taking steps and building the necessary supporting infrastructure for the acceleration on-stream process,” said Hudi in a written statement Monday (8/1).

Currently, the jumbo gas discovery in South Andaman is still in the early stages of exploration. Mubadala Energy is conducting a series of tests such as core analysis, fluid analysis, and then post-drill analysis.

Later, from the exploration and appraisal wells, an Exploration Status Determination (PSE) will be compiled as the basis for the development plan or Plan of Development (PoD) according to the results of technical, economic, and development scenario studies, up to commercialization.

“Regarding infrastructure including the construction of LNG refineries will be answered after the POD is completed. In general, this gas discovery will indeed need infrastructure to be commercialized,” said Hudi.