Choosing IPO Stocks During the Market Rebound

KONTAN.CO.ID - JAKARTA. Issuers that conduct initial public offerings (IPOs) may be considered one of the options for playing money on the stock exchange. Especially, when the domestic stock market tends to be in the middle of a strengthening trend.

There are around nine prospective issuers who are now lining up to list on the stock exchange. Eight prospective issuers are holding initial offerings (book building). Another one is in the pre-effective period.

One of the companies that will IPO is PT Sinar Eka Selaras Tbk (ERAL). ERAL is a subsidiary of gadget and technology issuer, PT Erajaya Swasembada Tbk (ERAA).

The company is engaged in the end-to-end retail trade business of computer products and electronic equipment, as well as several clothing brands.

ERAL offers as many as 1.03 billion shares, equivalent to 20% of its issued and paid-up capital.

With an offering price between Rp 370-Rp 410 per share, ERAL has the opportunity to pocket fresh funds of up to Rp 425.37 billion.

Baca Juga: Volume Melonjak, Tetap Hati-Hati Trading di Papan Pemantauan Khusus

Apart from ERAL, there is a non-primary consumer goods company that also attracts attention, namely PT Nusantara Sejahtera Raya Tbk (CNMA). CNMA owns the Cinema XXI cinema network, which, as of the end of last year, operated 1,216 screens in 225 cinema locations.

CNMA will release as many as 8.33 billion shares, equivalent to 10% of its issued and paid-up capital. With an offering price of Rp 270–Rp 288 per share, CNMA has the potential to pocket up to Rp 2.4 trillion from the IPO.

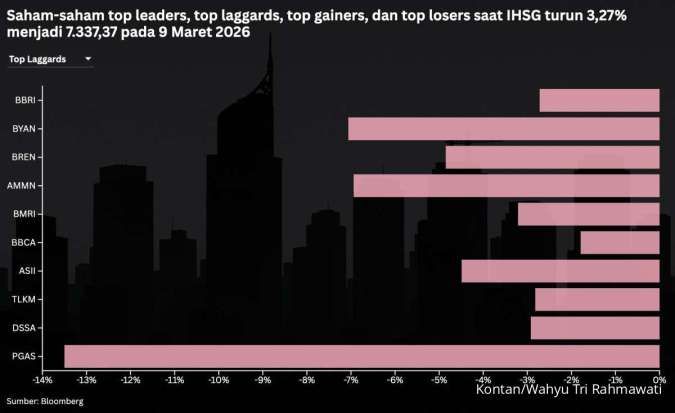

Analysts contacted by KONTAN believe that the initial public offerings of a number of issuers in the near future will make the IPO trend more positive. Their reasoning is that the celebration was held in more conducive market conditions. This is reflected in the Composite Stock Price Index (JCI), which is rebounding.

Head of Research at FAC Sekuritas Indonesia, Wisnu Prambudi Wibowo, assesses that the second semester is a good time for prospective issuers to offer their shares to the public. The stock market situation, he believes, is vibrant. One indicator is the JCI, which was able to skyrocket by 2.28% in the past week.

Foreign fund flows are also flooding the market, with the total net foreign buy still continuing. "When the market is conducive, usually IPO issuers are more in demand than when the market is quiet," Wisnu told KONTAN, Sunday (7/16).

On the other hand, Associate Director of Research and Investment Pilarmas Investindo Sekuritas, Maximilianus Nico Demus, said, in the midst of a conducive market, there are more attractive stock options to look at.

Therefore, investors have the opportunity to be more selective in choosing newly listed stocks.

Baca Juga: Emiten Konstruksi Geber Kontrak Baru

IPO selecting tricks

However, Nico warned, Don't be tempted by the lure of cheap IPO shares. Market participants still need to carefully select IPO stocks based on three criteria. These criteria include sector and company prospects, fundamental conditions, and potential valuations.

"Everything will return to those three points. If all three are proven, then market players will definitely look at these stocks. This gives investors more choices in investing," said Nico.

Head of Research Center Mirae Asset Sekuritas, Roger MM, added that, in addition to valuation, the portion of the IPO that is absorbed by the public also needs to be examined. Then, look for added value from sectoral momentum that is being exposed to fresh air.

In the general market outlook, Roger views the consumer goods, retail, and automotive sectors as attractive this year. Thus, according to Roger, the CNMA and ERAL IPOs have the opportunity to attract investor interest more than other IPOs.

"IPO stocks this time can be attractive, diverse, and from various sectors. It is interesting to follow several issuers. There are subsidiaries of ERAA and CNMA, which in the real sector are in contact with many consumers," said Roger.

Baca Juga: Vietnam Berharap pada LNG Impor, Namun Krisis Listrik Belum Tentu Tuntas!

Besides CNMA and ERAL, four other prospective issuers who are also in the book-building stage are PT Sinergi Inti Andalan Prima Tbk (INET), PT Mutuagung Lestari Tbk (MUTU), PT Minahasa Membangun Hebat Tbk (HBAT), and PT Royaltama Mulia Kontraktorindo Tbk (RMKO).

Two other issuers, namely PT Akselerasi Usaha Indonesia Tbk (AKSL), and PT Mandiri Herindo Adiperkasa Tbk (MAHA), are also conducting initial offerings. In addition, there is one prospective issuer that is in the pre-effective process, namely PT Multisarana Intan Eduka Tbk (MSIE).