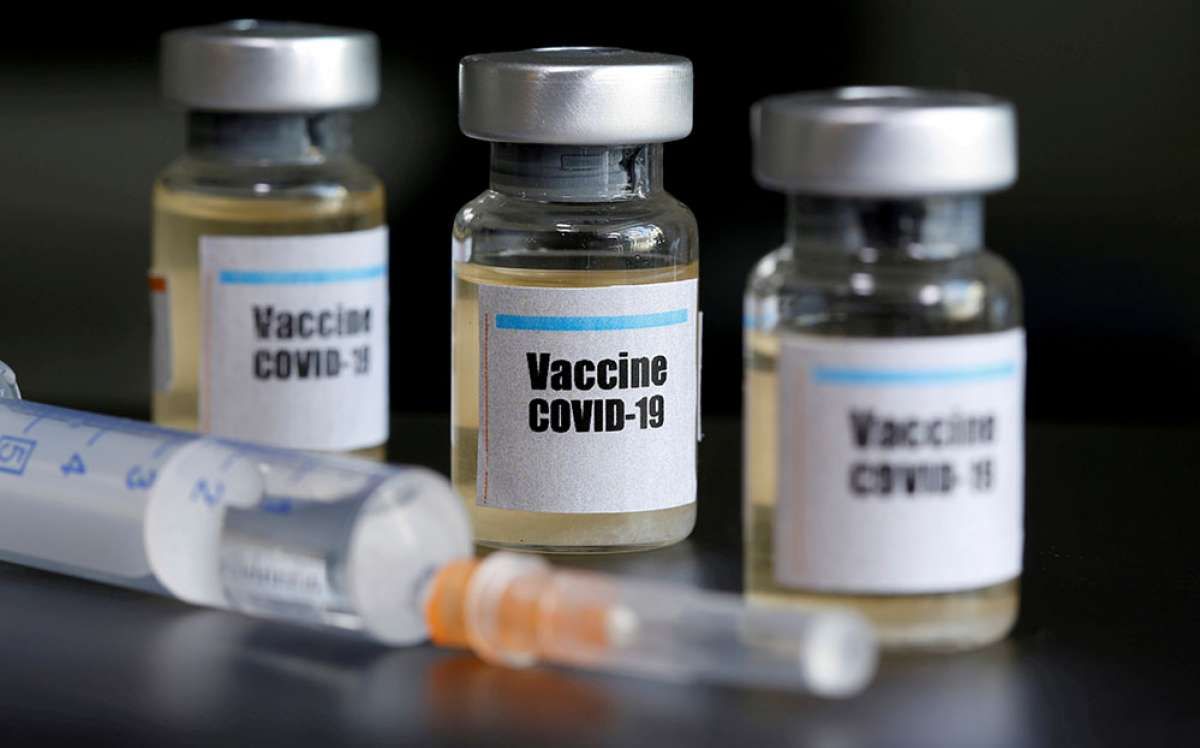

EU in Advanced Talks With Johnson & Johnson on Covid-19 Vaccine Deal

KONTAN.CO.ID - BRUSSELS (Reuters). The European Commission is in advanced talks with pharmaceutical giant Johnson & Johnson to reserve or buy up-front doses of its COVID-19 vaccine under development, two officials familiar with the talks told Reuters.

The move would be the first arranged by the European Union executive since it was mandated last week by the 27 EU national governments to use an emergency fund with more than 2 billion euros ($2.3 billion) available to reach advance purchase or call-option deals with up to six vaccine makers.

The Commission’s deal with the U.S. firm Johnson & Johnson is “in the pipeline”, a top health official from an EU member state said, asking to remain anonymous as was mentioning confidential discussions about vaccines between the EU executive and EU governments.

A second EU source said the Commission had a call with Johnson & Johnson on Tuesday over the possible agreement on its potential vaccine.

A Commission spokesman had no comment. Johnson & Johnson was not immediately available for comment outside U.S. business hours.

It was unclear whether any deal would involve an advance purchase of the vaccine in testing, or an option to buy it.

Johnson & Johnson plans next month to start human clinical trials for its experimental vaccine against the highly contagious coronavirus, which has infected more than 8.36 million people worldwide, with 447,985 deaths.

Germany, France, Italy and the Netherlands said last week they had acquired 400 million potential vaccine doses, in principle available to all member states, from British drugmaker AstraZeneca, which is developing a COVID-19 shot in conjunction with Oxford University.

AstraZeneca signed a similar deal in May with the United States.

The health official from an EU state said the EU deal with Johnson & Johnson could be announced as early as next week, but cautioned that it might take a little longer to finalise, and there were still chances it might not be struck at all.

EU decision-making procedures pose a sticking point for the potential deal, with member states still in talks over the establishment of a steering board for vaccine negotiations with drugmakers, officials told Reuters.

They said that under a draft plan devised by the EU Commission, which is still to be approved by EU governments, a green light from just four member states would be enough to start formal EU talks with a drugmaker.

But, underlining the urgency of securing a vaccine for the EU’s 450 million population, the Commission had already begun talks with Johnson & Johnson even before the steering board has been agreed.

By buying vaccines under development, the EU risks acquiring shots that may eventually prove unsuccessful against COVID-19.

But the risk is justified by the need to secure enough doses for the EU population in the global race for an effective vaccine, EU officials say.