PT Amman Mineral's US$3 Billion Investment in Smelter and Power Plants

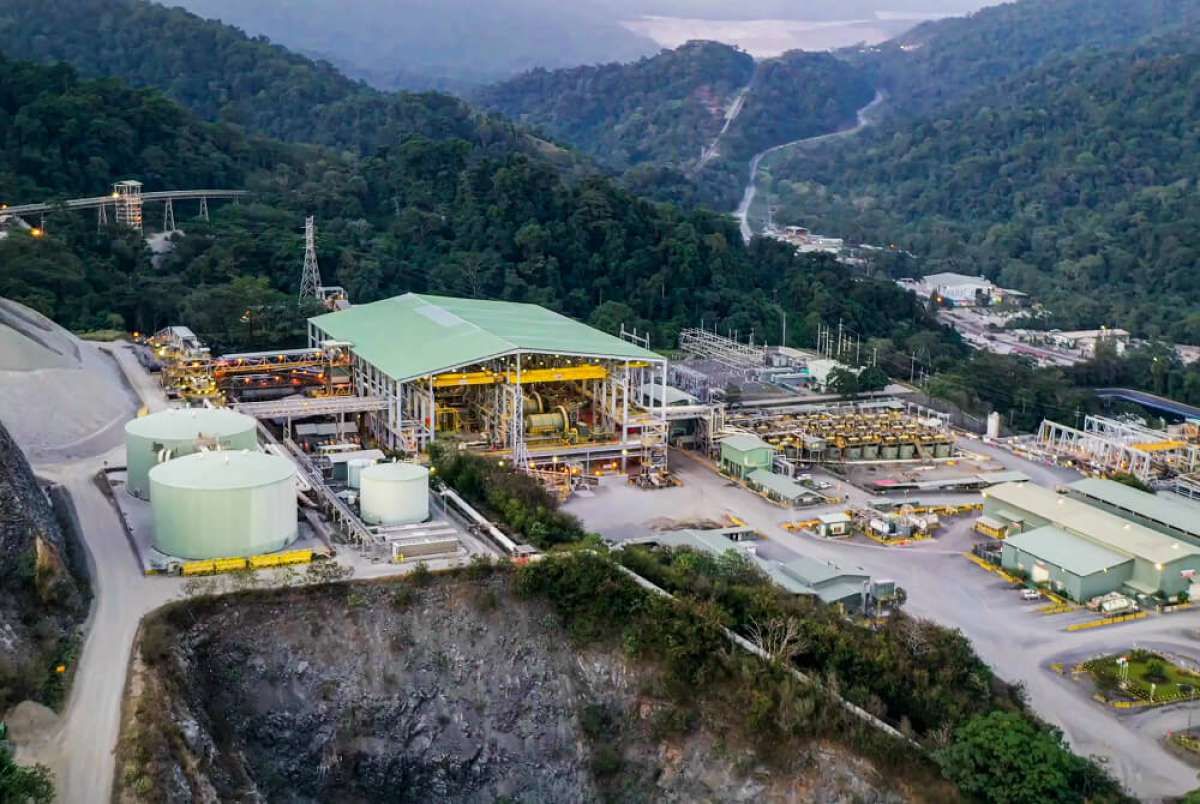

KONTAN.CO.ID - JAKARTA. The second largest copper and gold company in Indonesia after PT Freeport Indonesia, PT Amman Mineral Internasional (Amman Mineral) is committed to completing the construction of its smelter or refining plant. Amman Mineral showed this by building a processing plant to increase the production of copper concentrate volume.

Alexander Ramlie President Director of PT Amman Mineral Internasional said that in order for the smelter to work, Amman Mineral must increase the volume of its copper concentrate. "With the construction of a new processing plant, Amman's concentrate volume will increase from 120,000 tons per day to 260,000 tons per day," said the man who is familiarly called Alex, Tuesday (9/5).

Even to build a processing plant, the budget set aside by Amman Mineral reaches US$ 1.6 billion. "This figure is far greater than the smelter investment which is in the range of US$ 1 billion," said Alex.

Not only does the processing plant, support the running of the smelter, Amman Mineral also requires an additional supply of electricity. Currently, Amman Mineral's electricity supply comes from diesel and coal power plants. Amman Mineral is building a gas-fired power plant with a production capacity of 450 MW.

To build the power plant, Amman Mineral must invest no less than US$ 500 million. Amman Mineral also plans to build a solar power plant with a capacity of 400 to 500 MW. Including the company is reviewing a wind power plant with a capacity of 100-150 MW.

Just so you know, since 2022, Amman Mineral has operated a PLTS with a capacity of 26.8 MW. This PLTS is the largest in Indonesia for PLTS for mining operations. Regarding smelters, Amman Mineral has partnered with China Non-ferrous Metal Industry's Foreign Engineering and Construction Co. Ltd (NFC) for the construction of a smelter project.

With Amman Mineral's total capital expenditure (capex) to build a smelter and its supporting facilities that cost a total of US$ 3 billion, Alex said that his party was very serious about completing the smelter project in 2024.

Until now, the Batu Hijau mine, operated by PT Amman Mineral Nusa Tenggara (AMNT), a subsidiary of Amman Mineral, is the second largest copper and gold mine in Indonesia, after PT Freeport Indonesia. When combined with the Elang project, Amman Mineral's assets are one of the companies with the fifth largest copper equivalent reserves in the world with a total budget of 15 million tons (Mt). Meanwhile, the world's one to four largest respectively are Eascondida Chile (33.5 Mt), Grasberg PT Freeport Indonesia (30.1 Mt), Polish Copper (20.5 Mt), and Kerr Sulfurets Mitchell (15.7 Mt).

Historically, the Batu Hijau mine has contributed around 1% of global primary copper production. The Elang project is one of the world's largest undeveloped copper and gold deposits. The Batu Hijau mine and the Eagle project are strategically located to serve major regional demand centers, such as China, Japan, and South Korea.